How to Download Wise CSV Statement for Accounting

If you run your business through Wise (formerly TransferWise), your accountant will regularly request transaction…

If you run your business through Wise (formerly TransferWise), your accountant will regularly request transaction reports. One of the most convenient formats is CSV. In this guide, we’ll show you step by step how to get a CSV statement, even if you’re using Wise for the first time.

Why do you need a CSV report?

CSV reports allow your accountant to:

- import transactions into accounting systems;

- generate VAT, profit, and expense reports;

- submit tax declarations on time.

Step 1: Log in to Wise

Go to wise.com and log in. Make sure you have access to your business account if you are running a company.

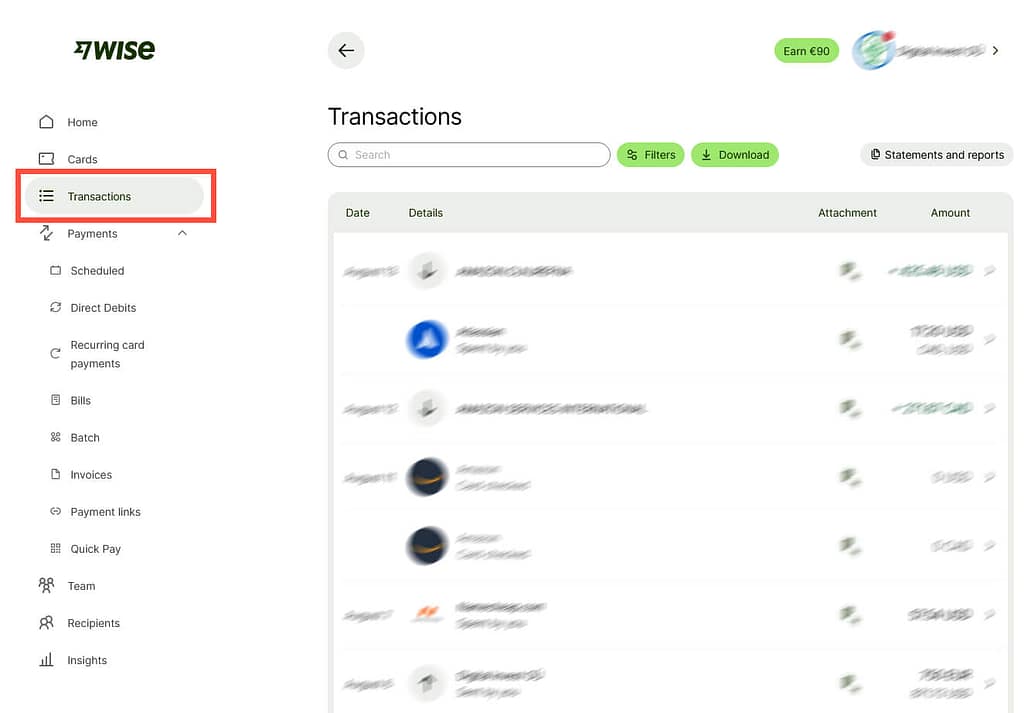

Step 2: Go to the “Transactions” section

In the top menu, select the “Transactions” tab to view your payment history.

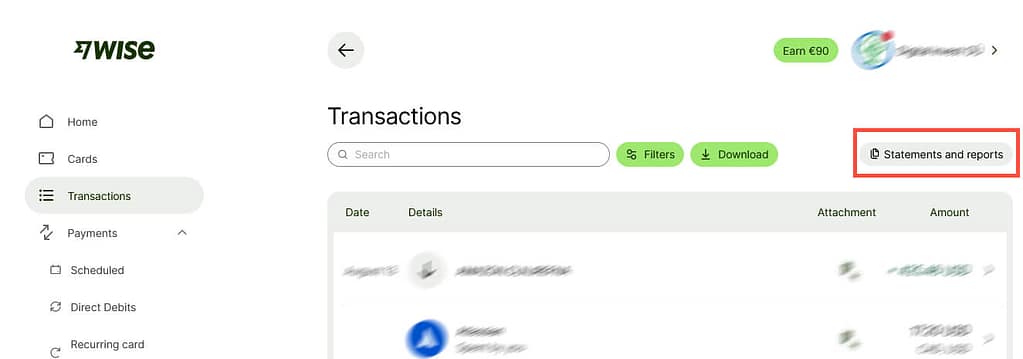

Step 3: Open “Statements and Reports”

On the right side of the search bar, click the “Statements and Reports” button — this will open the section with statements and reports.

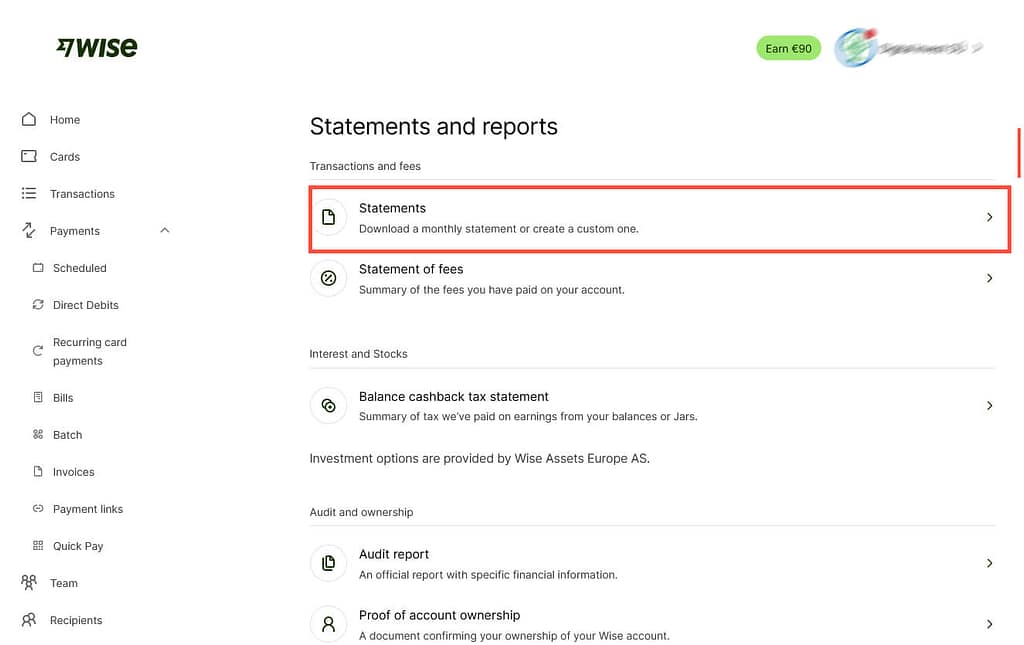

Step 4: Choose the required report

In the window that opens, select Statements (Download a monthly statement or create a custom one)

Step 5: Set the report parameters

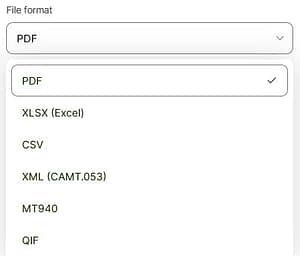

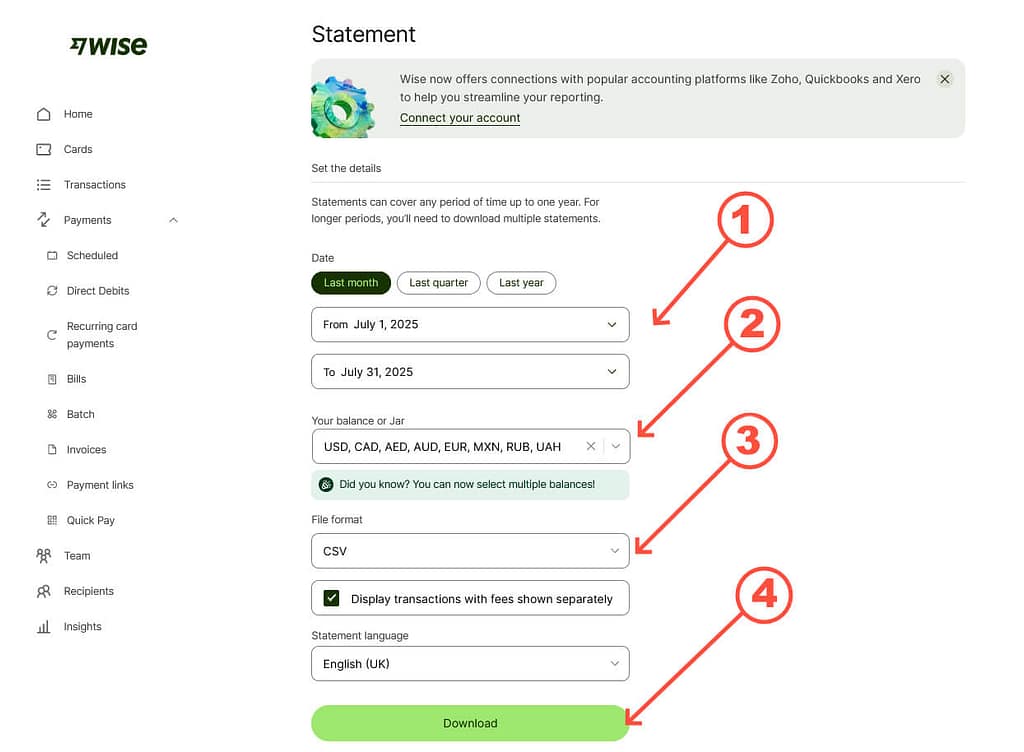

In the opened window, do the following:

- Select the date — usually, the previous month is chosen.

- Choose the currency or specific account. To include all accounts, click “Select all”.

- In the file format field, choose CSV, PDF, XML or other format.

- Click the “Download” button.

CSV is a simple table format that can be easily processed by any accounting software.

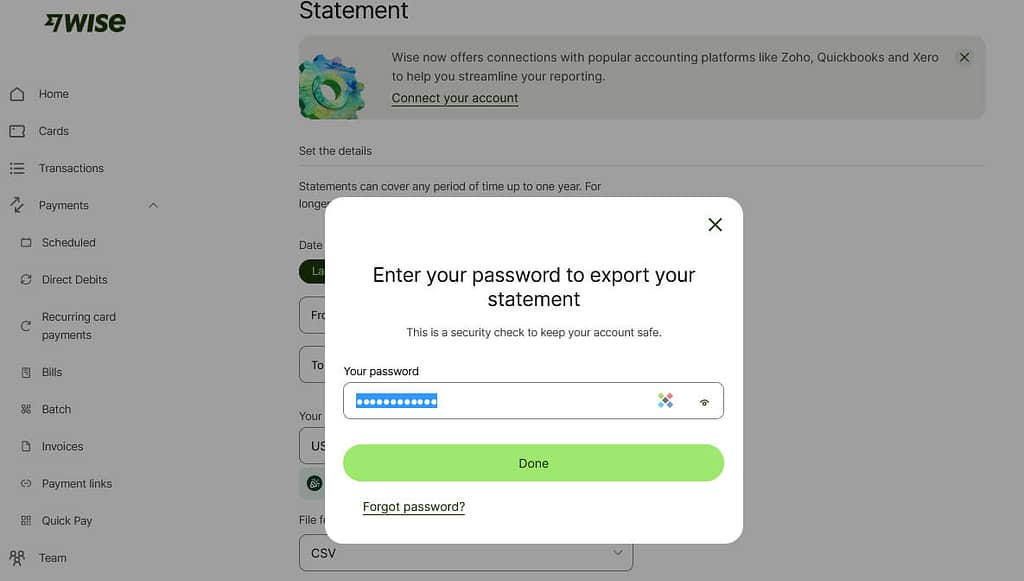

Step 6: Confirm the download

Wise may request your password or two-factor authentication. Once confirmed:

- The CSV file will be packed into a ZIP archive.

- Save it to your computer.

- Send the archive to your accountant.

Conclusion

Regularly sending CSV statements ensures accurate and timely reporting for your company. Use this instruction monthly or whenever your accountant requests it. If you are a GTPartner.ORG client, our accountant will always guide you on what exactly is needed and when.

Related services

Contact us to get started

Book a free consultation, and we'll identify the perfect solution for your needs and make the best offer for you.

Send Inquiry

Ready to get started or questions?

Reach out to us today and receive a reply within one business day!

Other articles

See also

Is it necessary to deposit the 2,500 € share capital when opening an OÜ in Estonia?

Short answer No. Since 1 February 2023, an OÜ no longer has a fixed minimum…

21 November 2025

Подробнее

See You at How to Web Conference 2025 in Bucharest

We are pleased to announce that GTPartner.ORG will participate in the largest tech conference in…

24 September 2025

Подробнее

How to Download Wise CSV Statement for Accounting

If you run your business through Wise (formerly TransferWise), your accountant will regularly request transaction…

18 August 2025

Подробнее