How to return the Share capital after registering a company

In Estonia, returning share capital from a private limited company (OÜ) is a very simple…

In Estonia, returning share capital from a private limited company (OÜ) is a very simple process. This article will help new company managers easily return the share capital that was paid during company registration.

For your convenience, GTPartner.ORG issues a single invoice that includes the state fee for company formation – €265 (as of April 2025) – and the amount of share capital you wish to contribute. This is designed to simplify your payment process. While we accept payments through any convenient method for you, the Estonian Business Register only accepts payments from Estonian banks. IBAN transfers are possible, but they significantly slow down the registration process.

When registering your company, we deposit the share capital on your behalf. In this case, registration with the Business Register can take from as little as 2 hours (our record in 2025) to 48 hours. After registration, you will begin the process of opening a business bank account with a suitable financial institution or payment system. For our clients, we personally recommend the most appropriate payment system depending on their country of residence.

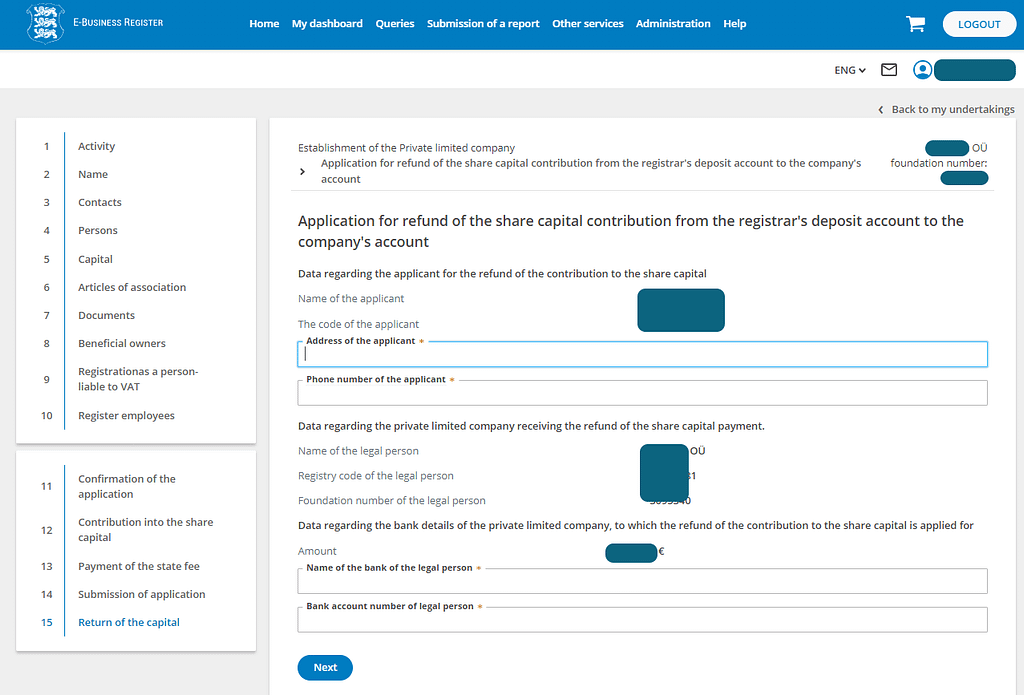

What you need before starting the capital return process

- The company must be registered in the commercial register.

- You must have an IBAN account registered in the company’s name that can receive funds (the account holder name must match your company name).

Step-by-step guide to submitting the application

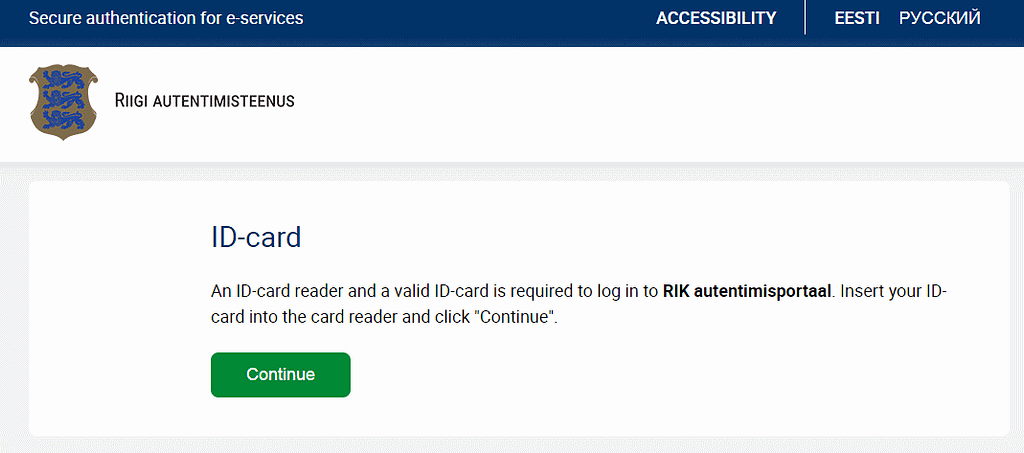

1. Log in to the electronic portal

Go to the Commercial Register portal and log in using your e-Residency card.

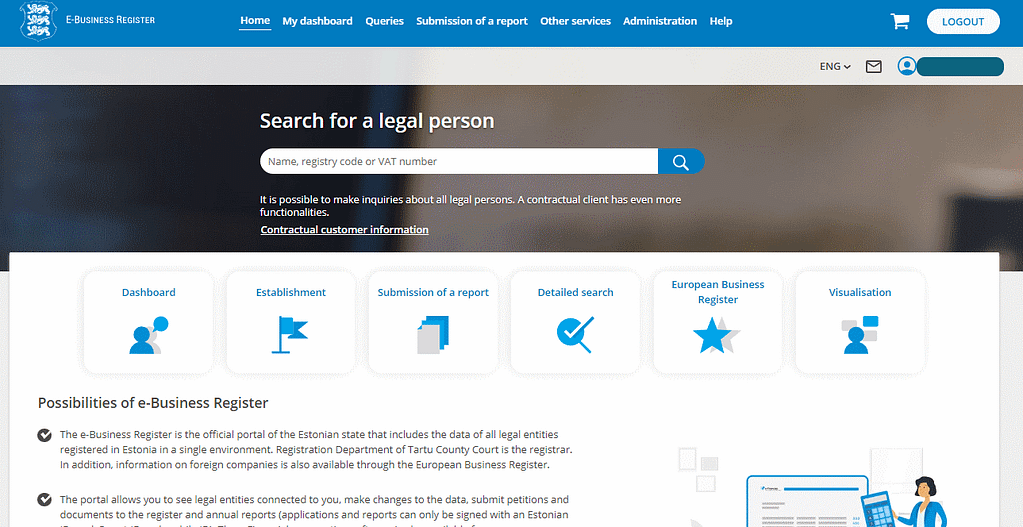

2. Go to your list of companies

Select “My dashboard” from the top menu or click the Dashboard button on the homepage.

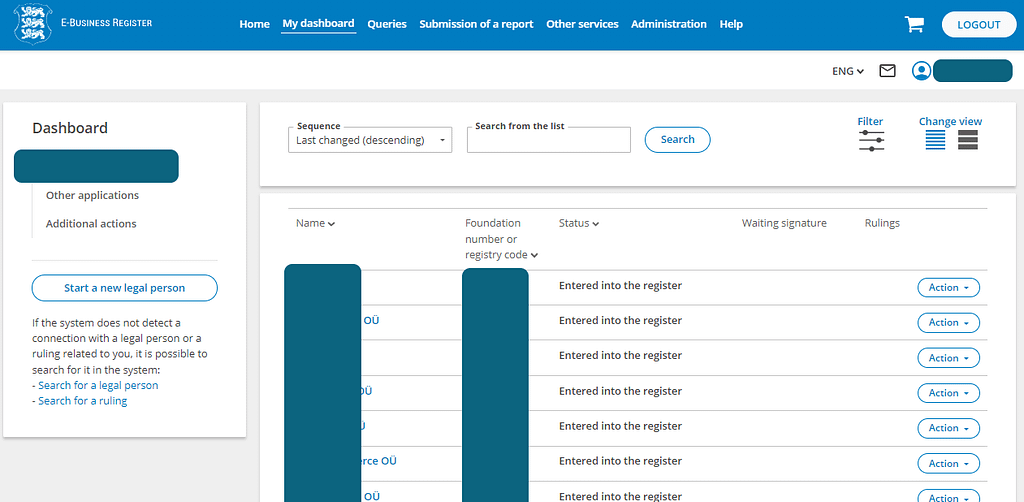

3. Select your company

After logging in, choose the company for which you want to submit the application.

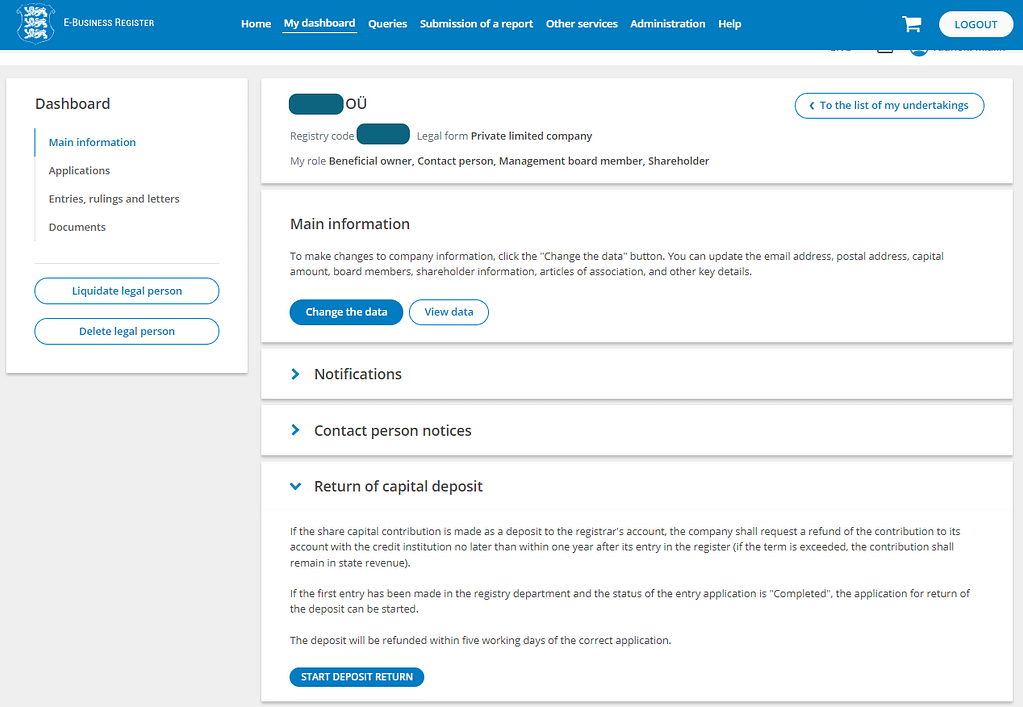

4. Submit the application

- Go to the “Main information” section.

- Select “Return of capital deposit (OÜ)”.

- Click the “START DEPOSIT RETURN” button.

5. Fill out the form

Please provide the following details:

- Address of the applicant (1) – the same address you submitted in the company registration form.

- Phone number of the applicant (2) – your phone number with country code, starting with +.

- Name of the bank of the legal person (3) – the name of the bank.

- Bank account number of the legal person (4) – the company’s IBAN account number.

6. Sign and submit

Review the application, sign it with your digital signature, and submit it through the portal.

Done! As you can see, it really is a simple process.

Related services

Contact us to get started

Book a free consultation, and we'll identify the perfect solution for your needs and make the best offer for you.

Send Inquiry

Ready to get started or questions?

Reach out to us today and receive a reply within one business day!

Other articles

See also

Is it necessary to deposit the 2,500 € share capital when opening an OÜ in Estonia?

Short answer No. Since 1 February 2023, an OÜ no longer has a fixed minimum…

21 November 2025

Подробнее

See You at How to Web Conference 2025 in Bucharest

We are pleased to announce that GTPartner.ORG will participate in the largest tech conference in…

24 September 2025

Подробнее

How to Download Wise CSV Statement for Accounting

If you run your business through Wise (formerly TransferWise), your accountant will regularly request transaction…

18 August 2025

Подробнее